All Categories

Featured

Take Into Consideration Using the dollar formula: penny represents Financial obligation, Income, Home Mortgage, and Education. Total your debts, home mortgage, and university expenses, plus your wage for the number of years your family members requires protection (e.g., till the kids run out the house), and that's your insurance coverage requirement. Some monetary specialists determine the quantity you require utilizing the Human Life Value ideology, which is your life time earnings potential what you're gaining now, and what you expect to earn in the future.

One way to do that is to search for firms with strong Financial stamina rankings. term life insurance singapore. 8A company that finances its very own plans: Some firms can sell plans from another insurance firm, and this can include an additional layer if you desire to change your policy or in the future when your family members requires a payment

A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called A(n)

Some companies offer this on a year-to-year basis and while you can expect your prices to climb substantially, it might be worth it for your survivors. One more means to contrast insurance companies is by considering on-line consumer testimonials. While these aren't likely to tell you a lot about a firm's monetary security, it can inform you how simple they are to deal with, and whether insurance claims servicing is an issue.

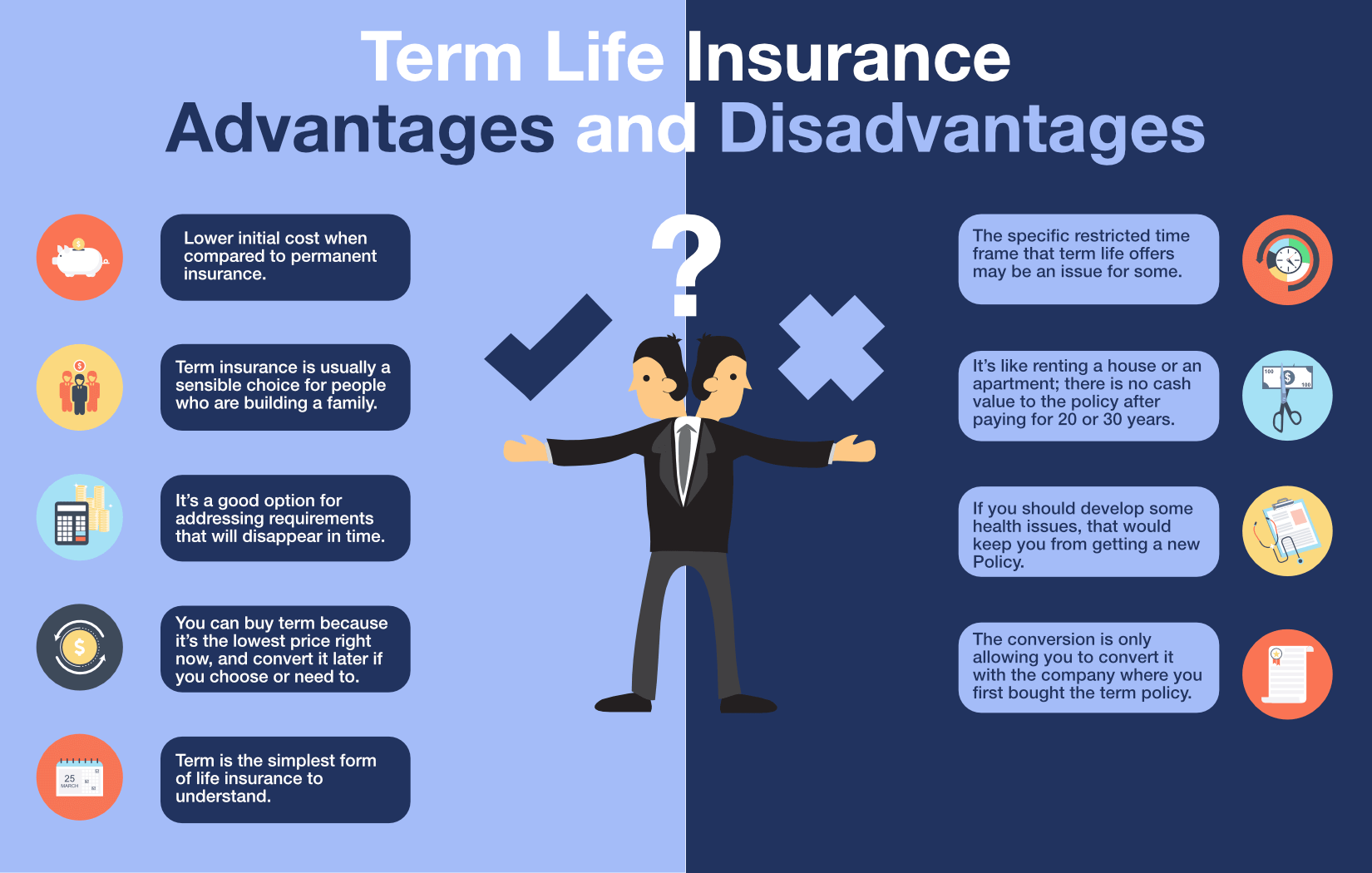

When you're younger, term life insurance policy can be a straightforward method to protect your liked ones. As life adjustments your economic priorities can also, so you may desire to have whole life insurance coverage for its life time protection and extra benefits that you can make use of while you're living. That's where a term conversion can be found in - who sells decreasing term life insurance.

Approval is guaranteed despite your health. The premiums will not increase when they're set, yet they will rise with age, so it's a great idea to lock them in early. Figure out even more concerning just how a term conversion works.

1Term life insurance provides momentary security for an essential duration of time and is normally much less costly than long-term life insurance policy. what is direct term life insurance. 2Term conversion guidelines and limitations, such as timing, may apply; for instance, there might be a ten-year conversion privilege for some items and a five-year conversion benefit for others

3Rider Insured's Paid-Up Insurance Acquisition Choice in New York. There is a price to exercise this cyclist. Not all taking part plan proprietors are qualified for rewards.

Latest Posts

What Is A 15 Year Term Life Insurance Policy

Which Of The Following Life Insurance Policies Combined Term Insurance

10 Year Term Life Insurance Meaning